Here’s a comprehensive overview of the decline of South Africa’s mining industry since 1994, structured across key dimensions:

- Gold Mining: The Core Collapse

Production drop

Gold output plunged from around 580 tonnes in 1994 to about 97 tonnes in 2023, marking a ~83% decline over that period . Independent data supports this trend: production peaked at 619 tonnes in 1993, and by 2024 it was reported at 100,000 kg (~100 tonnes) .

Workforce collapse

Employment in gold mining dropped from nearly 392,000 in 1994 to just under 94,000 in 2023, a workforce loss of nearly 76% .

Economic relevance decline

Gold’s GDP contribution fell from about 20% in the early 1980s down to roughly 6.3% by 2023 .

- Overall Mining Sector Transformation

Aggregate decline versus diversification

While total mining output has slowed, the decline masks a growing diversity. Core growth in non-gold sectors partially offsets overall losses:

Gold declined by about 5.8% per year since 1994.

Non-gold mining output, by contrast, expanded at an average of +1.3% annually .

Sector contribution to GDP

Mining’s direct contribution to GDP dropped from ~11% in 1994 to between 6%–7% by 2023–2025 .

- Employment Shifts and Job Losses

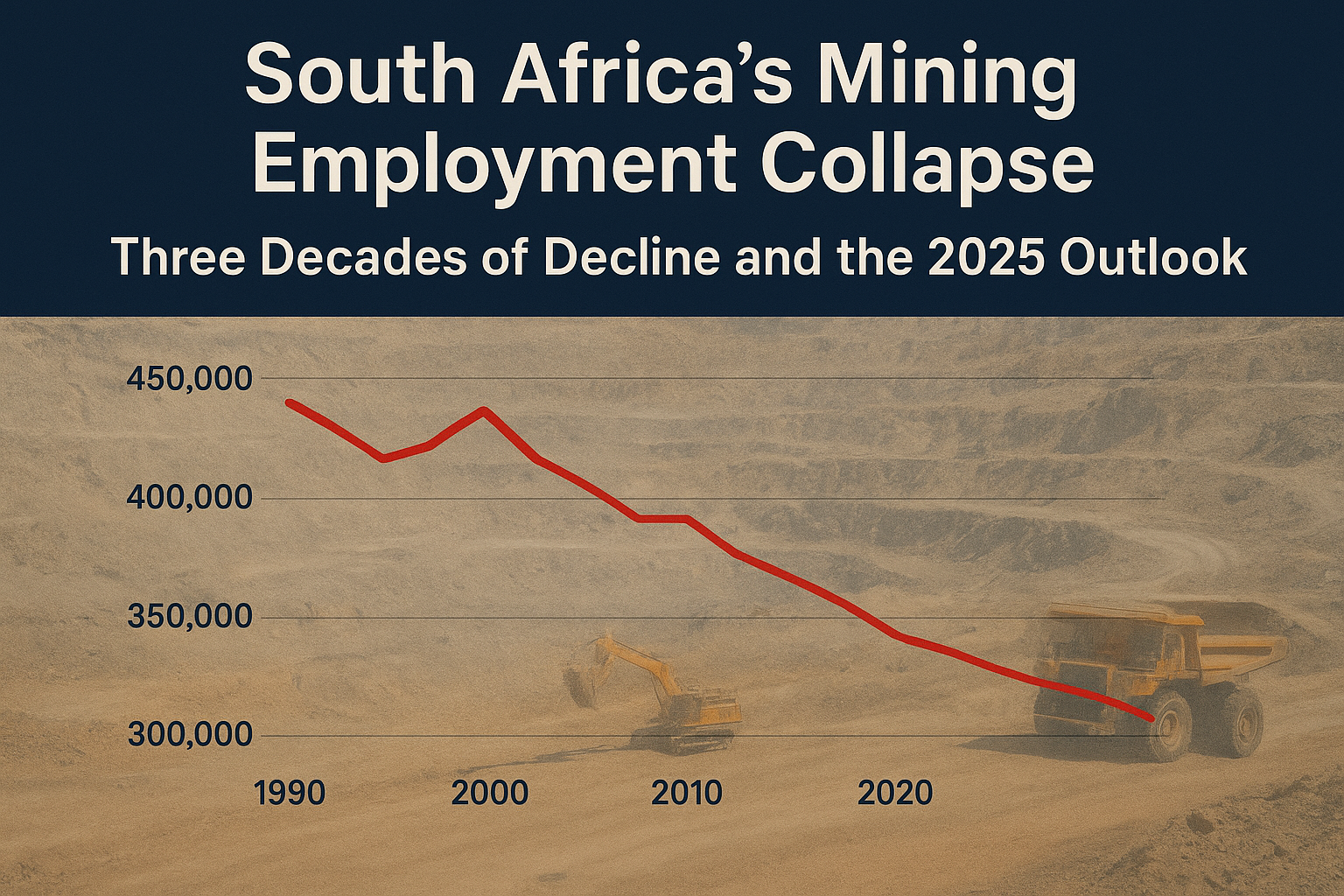

Overall employment contraction

Total mining sector employment decreased from around 611,000 in 1994 to approximately 480,000 by 2023 .

Historic job losses

Over 442,000 mining jobs have disappeared since the late 1980s—equivalent to losing ~12,000 jobs per year .

Non-gold employment gain

Employment in non-gold mining rose from 219,000 to 386,000 in the same period, partially offsetting gold sector losses .

- Underlying Causes of Decline

Several interlinked structural and operational factors have driven the downfall:

- Resource depletion & rising extractive costs

Gold reserves lie deeper underground, making mining increasingly expensive . - Global competition

South African mines lost ground to cheaper producers elsewhere . - Energy and infrastructure troubles

Frequent load shedding disrupts operations.

Poor rail and port logistics hamper exports .

- Regulatory and policy uncertainty

Unclear mining rights, licensing delays, and red tape discourage investment . - Commodity price pressures

Gold, PGMs, coal—all faced price declines; PGMs especially hit by decreased demand and production cost pressures . - Labour relations & strikes

Major disruptions, such as the 2014 platinum strike, caused huge losses to GDP, costs, and industrial relations . - Illegal mining (zama-zamas)

As formal operations diminish, illegal mining has surged, particularly in abandoned shafts—posing safety risks and significant revenue loss .

- Recent Performance & Future Risks (as of 2024–2025)

Profit sharp decline

Mining profits dropped from $10.6 billion in 2022 to $5.5 billion in the most recent fiscal year—a 50% decline .

Uncertain futures for key commodities

Gold industry may cease operations within 20–30 years without new investment.

Iron ore mining may last only another 13 years under current conditions .

2025 Production slump

In February 2025, mining production fell 9.6% year-on-year: PGMs down 23.9%, iron ore 10.5%, gold 7.6%, and coal 4.3%. Mineral sales at current prices dropped 12.9% .

Electricity cost and regulation burden

Eskom tariffs rose 12.7%, further squeezing margins. Regulatory and logistical constraints persist .

- Summary Table

Dimension Trend Since 1994

Gold Production ↓ ~80–85% (580 t → ~97 t)

Gold Employment ↓ ~76% (392k → 94k)

Total Mining Output ↓ ~0.4% annually; non-gold sectors grew mildly

Overall Mining GDP % ↓ from ~11% to ~6–7%

Total Employment ↓ from ~611k to ~480k

Annual Job Losses ~12k per year (since late 1980s)

Current Risks High extraction, poor infrastructure, regulatory hurdles

Future Outlook If unaddressed, gold & iron sectors may collapse in decades

Be First to Comment